What is valuation for Purchase Price Allocation?

A purchase price allocation valuation, also known as “allocation of purchase price,” is a method used to determine the value of different assets and liabilities of a company that is being acquired. It is typically performed at the time of a merger or acquisition to allocate the purchase price of the company among its various assets and liabilities.

As an example, a company SubCo is being acquired by another company ParentCo. The purchase price is $7M. The purchase price allocation valuation helps to determine how much of the $7M is allocated to each specific asset or liability of the company SubCo.

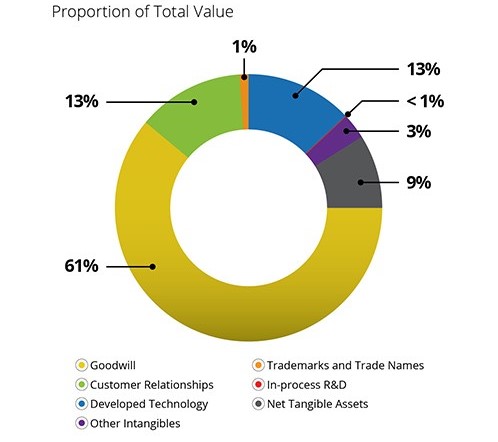

For example, $3M of the purchase price may be allocated to the company’s patents, $1.5M to its customer base, $1M to its trademark, $0.5M to its non-compete agreements, $1M to workforce and goodwill, $1M to its real estate and $1M to its liabilities. This information is used for tax and financial reporting purposes, and also helps the acquirer to understand the value they are getting from the acquisition.

In simpler terms, a purchase price allocation valuation is a way of dividing the cost of a business that is being bought, into different parts, to understand how much of the cost is attributed to each asset or liability of the company.

At Aspen Valuations, we are experienced in preparing purchase price allocation valuations for financial reporting purposes to assist accountants and their clients, many of which are publicly listed companies in the Toronto Stock Exchange.

Reach out to us to discuss how we can assist you.