Omitting this reasonableness check can result in a misleading business value

2.5 min read.

According to the Canadian Federation of Independent Business (CFIB), nearly three quarters (72%) of small business owners intend to exit their business in the next 10 years. Considering that, it’s essential to know how to calculate the value of your business before beginning negotiation.

In valuing an operating business, it is common to use the income approach as the primary approach while using another approach (such as asset approach or market approach) as a sense check to ensure the value arrived at is accurate and defensible.

Under the market approach, the comparable transaction analysis is commonly used. This approach looks for similar or comparable past transactions of companies in the same industry that were sold and at what multiples these companies were sold for. These multiples include Price to Earnings (P / E), Enterprise Value EBITDA (EV / EBITDA) or Enterprise Value to Revenue (EV / Revenue).

When used as either a primary approach or a secondary approach to check for reasonableness, the Comparable Transaction Analysis is important because various factors, such as the industry of operation, type of business, influence the price a potential purchaser would pay for this business. Comparable transaction multiples can provide persuasive evidence of what market participants actually pay for businesses that are similar to the subject company.

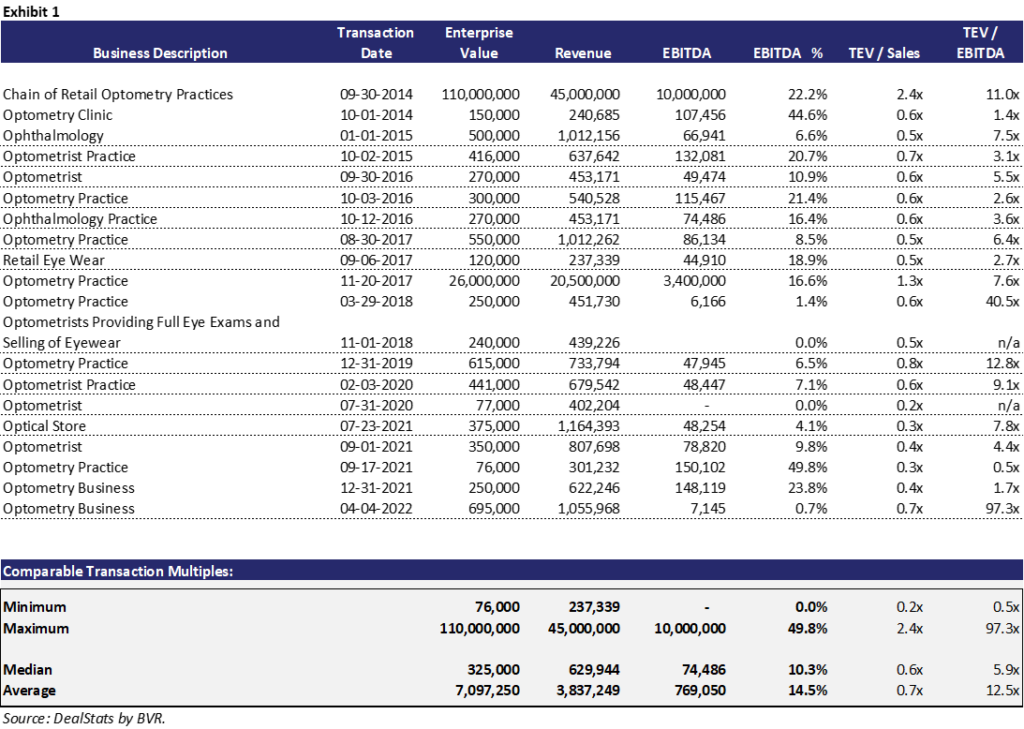

The steps taken in this method include finding transactions involving comparable companies, selecting the transactions that closely mirror the company’s operations and which occurred in similar industry and economic conditions, and finally, applying the indicated pricing multiples from the selected transactions. The exhibit below demonstrates the financial metrics and sale multiples for sale transactions of optometry clinics.

As demonstrated, prior to any further detailed examination, the transactions of optometry clinics provide a wide range of multiples (i.e. EV / EBITDA multiple in the range from 0.5x to 97.3x) and EV / Revenue multiple from 0.2x to 2.4x). This may not be very useful or accurate to apply in valuing our subject company.

The accuracy and quality of this analysis depend entirely on selecting the most applicable transactions. A skilled valuator would look at criteria such as industry, company size, geography, time, etc. to ensure an apple-to-apple comparison. Transactions (companies) that are not a proxy to the subject company would be eliminated from the analysis.

For example, companies that are too large or too small compared to the subject company should be eliminated. Timing of transactions is an important factor – more recent transactions are more relevant. Those that occurred several years ago may not reflect what the market would pay for similar transactions at the present date and therefore should be eliminated from the analysis. In addition, transaction multiples that are too high or too low compared to industry norms suggest the transactions are outliers and should be eliminated.

Exhibit 2 below illustrates the EV / EBITDA and EV / Revenue multiple ranges of similar companies after the elimination of transactions that are not relevant or comparable. The multiple ranges become more relevant and usable in valuing our subject company.

To learn more, book a free consultation with us.