Valuation Insights from 2023 M&A Trends

Navigating the intricacies of business valuation often involves observing the most recent M&A transactions. These give insight into the prevailing market valuation trends and provide a snapshot of the factors that drive interest in particular sectors.

Recent Downtrend in M&A Activities

According to data collated by grata.com, a leading M&A data resource for private companies, 2023 has witnessed a downturn in deal volume, with the ripple effects seen almost across the board. However, amid the decline, five industries emerged as the top performers:

- Software: This sector’s resilience in the M&A space stems from its recurring revenue nature, which proves especially enticing to strategic buyers like private equity firms.

- Insurance Services: Companies operating as insurance brokerages or agencies have been particularly appealing, with a significant portion of their revenue model based on the recurring nature of trailer fees.

- Information Technology (IT): The IT sector is characterized by its fragmented nature, brimming with smaller businesses. Despite the downturn, stable valuations have been maintained throughout the industry. It’s noteworthy that businesses boasting proprietary software (termed “software enabled”) have experienced a spike in their valuation multiples.

- Consulting: Much like IT, the consulting sector is heavily fragmented. In the face of the downturn, this industry’s M&A trend remains steady, with its valuation multiples mirroring the overarching trend of service businesses.

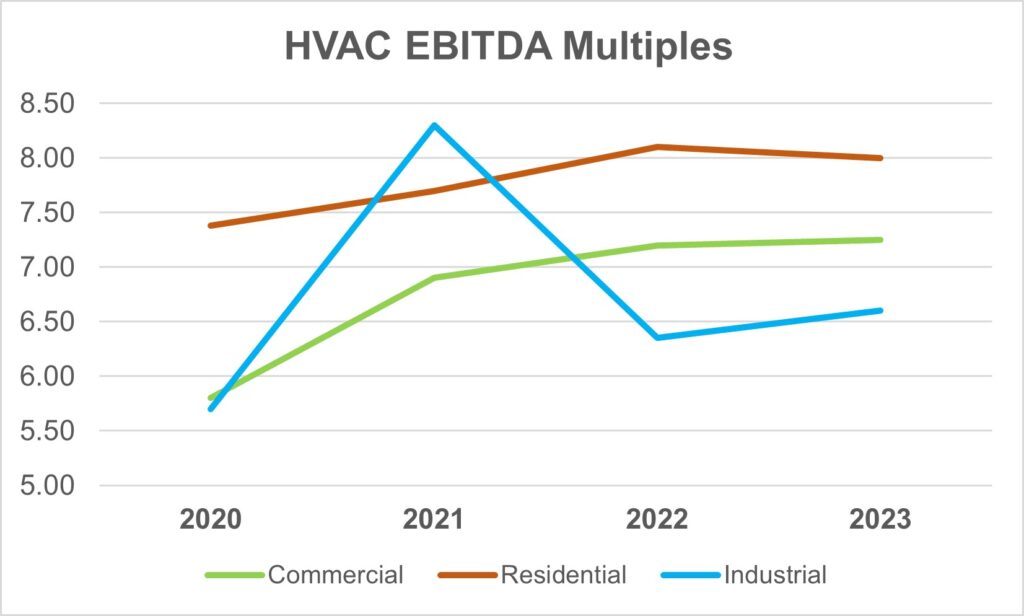

- Plumbing and HVAC Contractors: Indications suggest that this industry is drifting towards consolidation. HVAC valuation multiples saw a notable uptick in late 2022, making it one of the sectors with the most significant multiple increases up to Q3 2023. Delving deeper, it’s intriguing to observe that residential HVAC multiples presently surpass those of their commercial or industrial counterparts. This phenomenon is partly attributed to many residential HVAC providers offering maintenance service programs, a strategy that yields the rewards of consiste

nt, recurring service revenue.

nt, recurring service revenue.

Ready to Determine Your Business’s Worth?

Navigating the complexities of business valuation requires expertise and a keen understanding of market trends. If you’re considering a sale, acquisition, or simply want to understand your business’s value in the current market, our seasoned valuation experts are here to guide you. Don’t navigate this journey alone. Book a Free Consultation with Our Valuation Experts today!