Why do definitions of value matter?

1 min read.

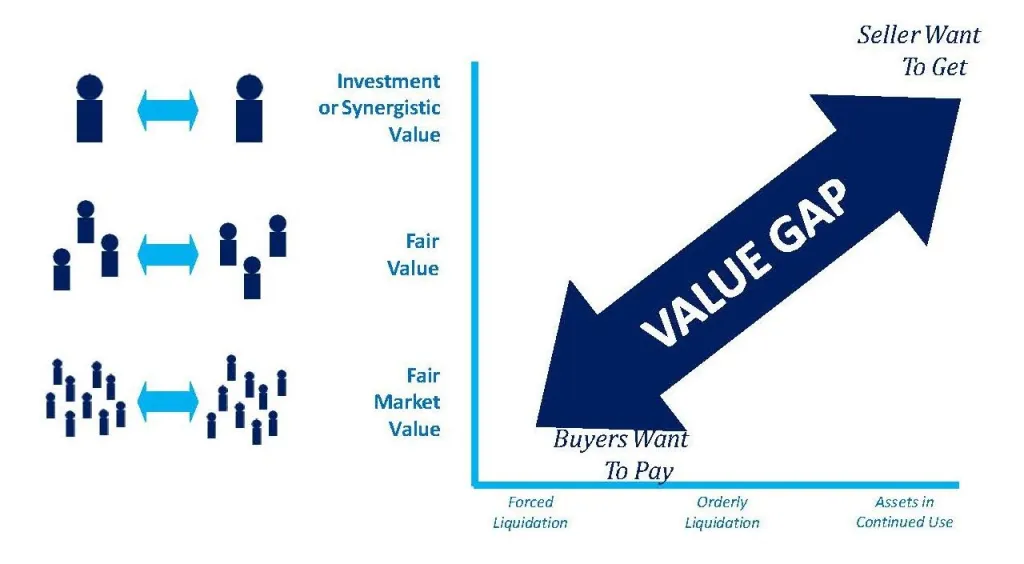

In business valuations, there can be confusion regarding the standards of value (or definitions of value) for clients or non-valuation professionals.

Different standards of value result in different values for a business. So which standard of value to use? It depends on the purpose of the valuation and your answer to “value to whom?”.

It can be seen that the choice of exit options and the likely transaction at exit have a significant impact on value. For example, by definition, Fair Market Value (FMV) is the hypothetical price a willing buyer and willing seller, with mutual knowledge of all relevant facts and not acting under any compulsion, would agree upon for the company. FMV does not take into account any synergistic benefits a buyer may be willing to pay for and therefore results in a lower value than the Synergistic Value. FMV is probably the most commonly used standard of value. It is required for most valuations done for tax purposes, legal proceedings, Employee Stock Option Plans (ESOPs) and financial reporting, etc.

On the other hand, the Synergistic Value of a company is its value to a specific investor, such as a competitor or a successor in a family business. This value takes into account the synergistic value (such as revenue synergies, cost synergies, financial or market synergies) this buyer may be willing to pay.

A buyer could calculate the Synergistic Value for an acquisition target, pay a price consistent with the Fair Market Value, and then record the acquisition on their books at Fair Value (Fair Value is the standard of value required for financial reporting). Each of which could result in a different value measurement.

This diagram may help demonstrate the major standards of value used in business valuations and their impact on value results.

Book a free consultation with us to chat more.